What You Need to Know About Private Mortgage Insurance (PMI)

Whether it is your first time or your fifth, it is always important to know all the facts when it comes to buying a home. With the large number of mortgage programs available that allow buyers to purchase homes with down payments below 20%, you can never have too much information about Private Mortgage Insurance (PMI).

What is PMI?

Freddie Mac defines PMI as:

“An insurance policy that protects the lender if you are unable to pay your mortgage. It’s a monthly fee, rolled into your mortgage payment, that is required for all conforming, conventional loans that have down payments less than 20%.

Once you’ve built equity of 20% in your home, you can cancel your PMI and remove that expense from your mortgage payment.”

As the borrower, you pay the monthly premiums for the insurance policy, and the lender is the beneficiary. Freddie Mac goes on to explain that:

“The cost of PMI varies based on your loan-to-value ratio – the amount you owe on your mortgage compared to its value – and credit score, but you can expect to pay between $30 and $70 per month for every $100,000 borrowed.”

According to the National Association of Realtors, the average down payment for all buyers last year was 13%. For first-time buyers, that number dropped to 7%, while repeat buyers put down 16% (no doubt aided by the sale of their homes). For a large number of buyers last year, PMI did not stop them from buying their dream homes.

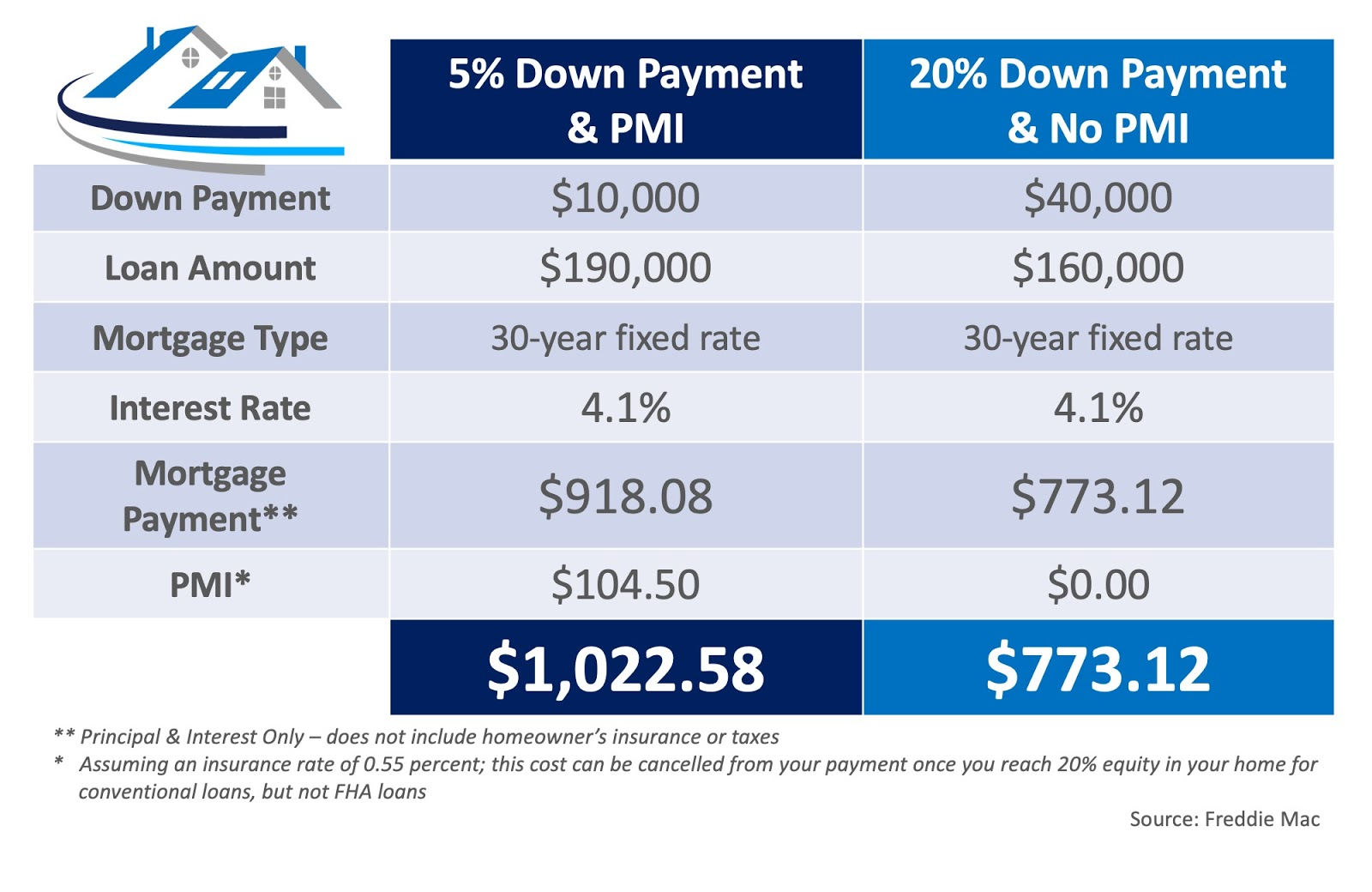

Here’s an example of the cost of a mortgage on a $200,000 home with a 5% down payment & PMI, compared to a 20% down payment without PMI:

The larger the down payment you can make, the lower your monthly housing cost will be, but Freddie Mac urges you to remember:

“It’s no doubt an added cost, but it’s enabling you to buy now and begin building equity versus waiting 5 to 10 years to build enough savings for a 20% down payment.”

Bottom Line

If you have questions about whether you should buy now or wait until you’ve saved a larger down payment, let’s get together to discuss our market’s conditions and help you make the best decision for you and your family.

Our client processes.

Don't forget to check out our real estate selling experience information.

Purchasing a home?

We've got your buyer concerns and questions covered.

-1.png)

-1.png)